Bitcoin stabilized at around $41,000 on Friday and is down about 9% over the past week. Analysts expect prices to move sideways, although they may be vulnerable to further declines if technical support levels are breached.

The reduction in leverage in bitcoin and ether futures markets could signal healthier market conditions. Typically, there is a lower chance of additional downside volatility when traders reduce their position sizes.

Earlier this week, “based on liquidation data, it seems like a few leverage traders tried to speculate on a rebound and got burned in the process,” Genevieve Yeoh, a research analyst at Delphi Digital, wrote in a blog post.

Liquidations, which can accelerate downward price movements, occur when an exchange forcefully closes a trader’s leveraged position as a safety mechanism due to a partial or total loss of the trader’s initial margin. That happens primarily in futures trading.

For now, bitcoin remains near a three-month low, tracking declines in global equity markets.

Latest Prices

- Bitcoin (BTC): $41,928, -2.97%

- Ether (ETH): $3,216, -6.11%

- S&P 500: $4,677, -0.41%

- Gold: $1,795, +0.19%

- 10-year Treasury yield closed at 1.76%

Traders reduce risk

Some analysts are pointing to signs of stabilization in crypto markets following Wednesday’s sell-off. After roughly $800 million in liquidations during the price dip, selling pressure could subside over the short term.

“We have already seen significant de-risking in recent weeks with both BTC and ETH perpetual swap funding rates near zero,” David Duong, head of institutional research at Coinbase, wrote in a newsletter on Friday.

A perpetual swap is a type of crypto derivative trading product, similar to traditional futures.

“Leverage has been reduced sharply, reflected in the BTC basis falling from 20% in early Q3 2021 to 5% in January 2022 and the ETH basis falling from 20% to 2% over the same period (according to Deribit),” Duong wrote.

Exchange outflows

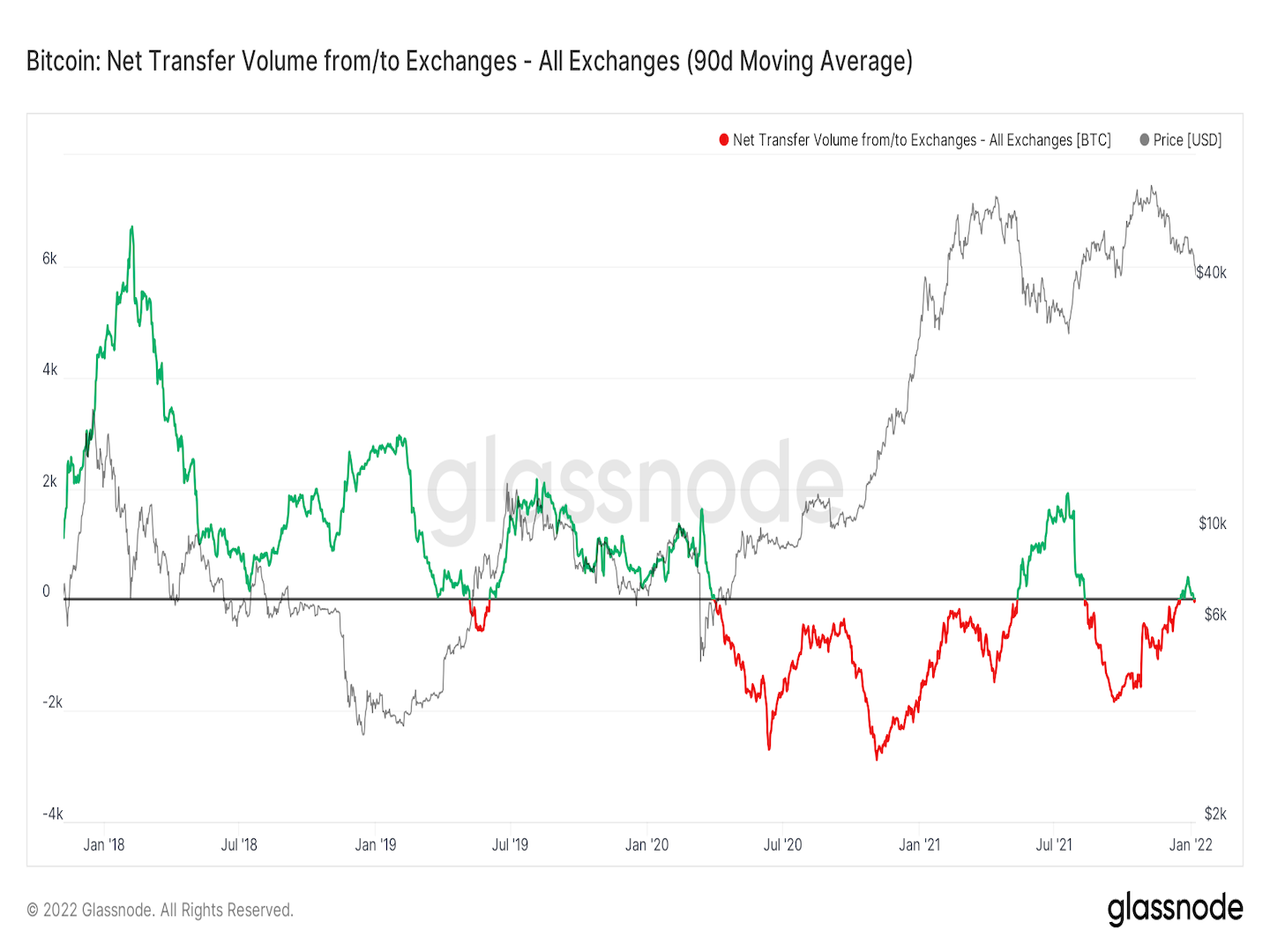

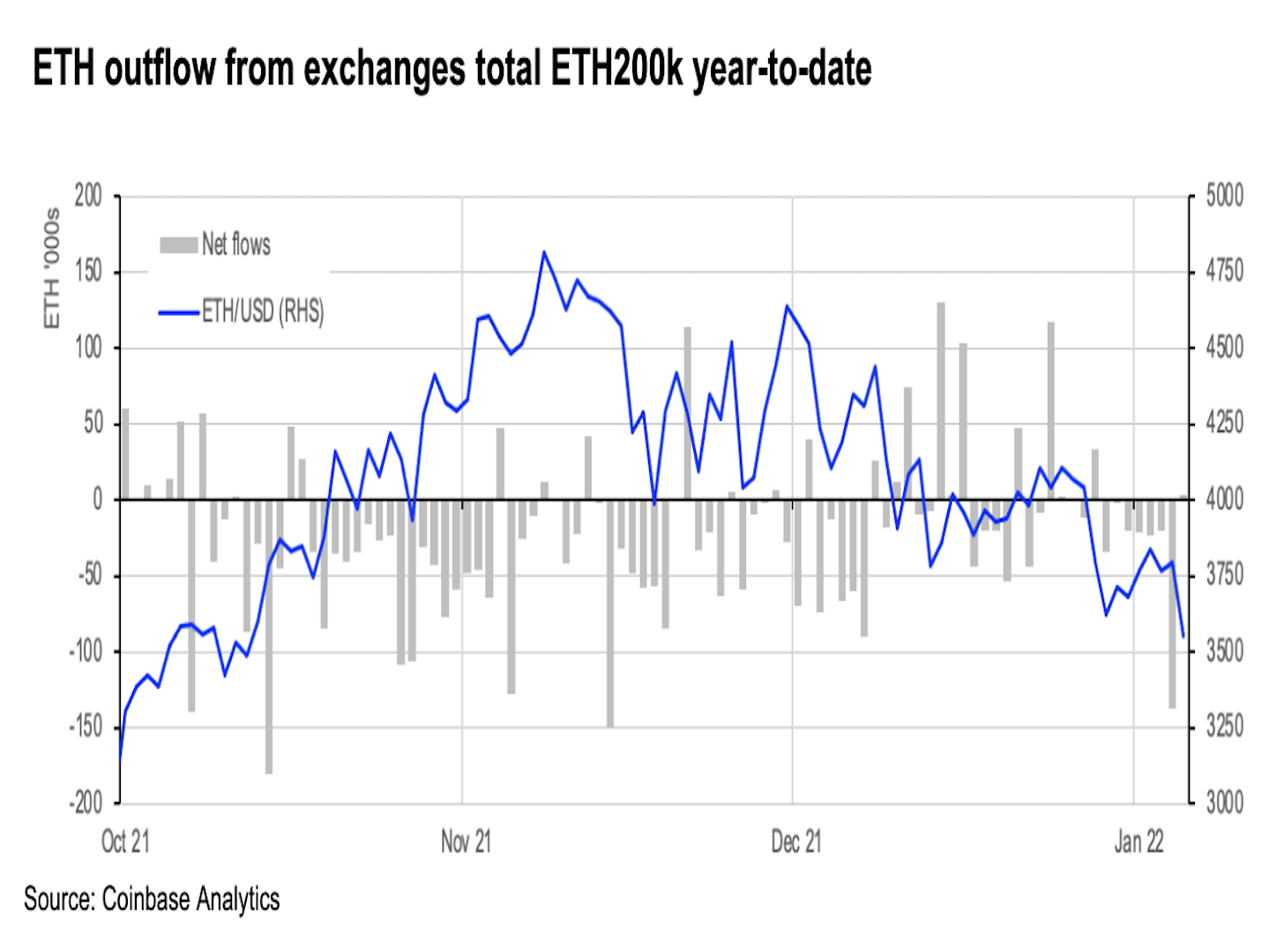

The net flow of bitcoin and ether to and from exchanges has trended lower over the past year. This week, however, more BTC moved into exchanges, which could signal a bearish shift in investor sentiment.

Net inflows imply investor intention to sell, while consistent outflows represent strong holding sentiment and take out circulating supply from the market, paving the way for price rallies.

While the recent uptick in net inflows to exchanges doesn’t signal a trend shift, analysts are closely monitoring a sustained rise similar to January, which could lead to a prolonged market sell-off.

Bitcoin's net transfer volume to and from exchanges (Glassnode)

ETH outflow from exchanges (Coinbase Analytics)

Altcoin roundup

- Ether liquidations: Traders racked up $182 million in losses on ether-tracked futures products in the past 24 hours, according to data from analytics tools Coinglass. That is $14 million higher than bitcoin-tracked futures, which usually see the largest liquidations in the crypto market, during a comparable period.

- Serum’s fund raise: The protocol that undergirds much of decentralized finance (DeFi) on the Solana blockchain is raising funds to expand operations, and about $70 million has been committed so far. Buyers in the funding round received both Serum’s SRM tokens as well as a portion of the ecosystem fund, with 85% going into the fund. Ecosystem funds are a growing trend among major projects. Read more here.

- Avalanche’s wonderland: Algorithmic money market Wonderland has made a seed investment in Polygon-based decentralized betting application BetSwap, the team said in a post on Friday. The move marked one of the first instances of a community-governed crypto project investing in a DeFi protocol, which rely on smart contracts instead of third parties in providing financial services.

Post a Comment